39+ How much money can i borrow for a house

Theyll also look at your assets and. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Get Car Title Loans In Red Deer Car Title Deer Car Red Deer

The maximum you could borrow from most lenders is around.

. Ad Get Instantly Matched With Your Ideal Home Mortgage Loan Lender. Find A Lender That Offers Great Service. When you apply for a mortgage lenders calculate how much theyll lend.

The Best Companies All In 1 Place. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Under this particular formula a person that is earning.

Were Americas 1 Online Lender. This mortgage calculator will show how much you can afford. This ratio says that.

1 10000 or half your vested account balance. In order to calculate how much you could borrow we need to base our. This is due to the fact that a.

This borrowing calculator is intended as a guide only and is based on the Residential Owner Occupied rate. Its A Match Made In Heaven. Book an appointment Start pre-approval application.

Were Americas 1 Online Lender. The more you put toward a down payment the lower your LTV ratio will be. Fill in the entry fields.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Find out how much you could borrow. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

Expect a rate of 1 for every 100000 so a 340000 home would have a millage rate of 3400. Ad Our technology will match you with the best cash out refinance lenders at super low rates. Skip the Bank Save.

Get Started Now With Quicken Loans. For this reason our calculator uses your. Looking For A Mortgage.

Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Click Now Apply Online. Calculate what you can afford and more The first step in buying a house is determining your budget.

The average cost to build a house is 248000 or between 100 and 155 per square foot depending on where you live the size of the property and whether modern or. We calculate this based on a simple income multiple but in reality its much more complex. The calculation shows how much lenders could let you borrow based on your income.

A Rating with BBB. Estimate how much you can borrow for your home loan using our borrowing power calculator. Its A Match Made In Heaven.

View your borrowing capacity and estimated home loan repayments Banking. The exact score you need will depend on a few factors. Your financial standing will also affect the rate you are able to receive on.

You to save money and borrow money with much greater efficiency and superior financial performance than any other system you are currently using. Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best. You can borrow up to.

Ad Compare Lowest Home Loan Lender Rates Today in 2022. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. Compare More Than Just Rates.

Save Time Money. Looking For A Mortgage. Add up your monthly expenses for housing.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. The average cost to build a house is 248000 or between 100 and 155 per square foot depending on where you live the size of the property and whether modern or. Over 15 million customers served since 2005.

Ad Compare Mortgage Options Get Quotes. Ad Calculate Your Payment with 0 Down. Get Started Now With Quicken Loans.

Show me how it works. You can borrow the lesser of either. The first option for using a 401k to purchase a home is borrowing from your account.

How much can I borrow. If youre buying a home thats worth 200000 and you put down 20000 you will have a balance of. Where you borrow money from.

This calculator is for informational and general illustrative purposes only. Veterans Use This Powerful VA Loan Benefit for Your Next Home. The front-end ratio should be no higher than 28 percent of your pre-tax income 31 for FHA-backed loans.

Figure out how much mortgage you can afford. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income.

Ad Compare Mortgage Options Get Quotes. Get Instantly Matched with the Best Personal Loan Option for You. The minimum credit score you need to get a home renovation loan will be between 650 and 700.

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Loan Constant Tables Double Entry Bookkeeping Mortgage Loans Mortgage Calculator Loan

Pin By Rachh L On Cash 30 Year Mortgage 15 Years 30 Years

Word Of The Day Learn English Words English Words Learn Accounting

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Avoid Losing Your Money Property Investment Opportunity For Ofws Share To Inspire Investment Property Investing Money Habits

Business Loans Flat Concept Icon In 2022 Business Loans Loan Concept

Karvi Loans Lending Company Money Lending Loan

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage

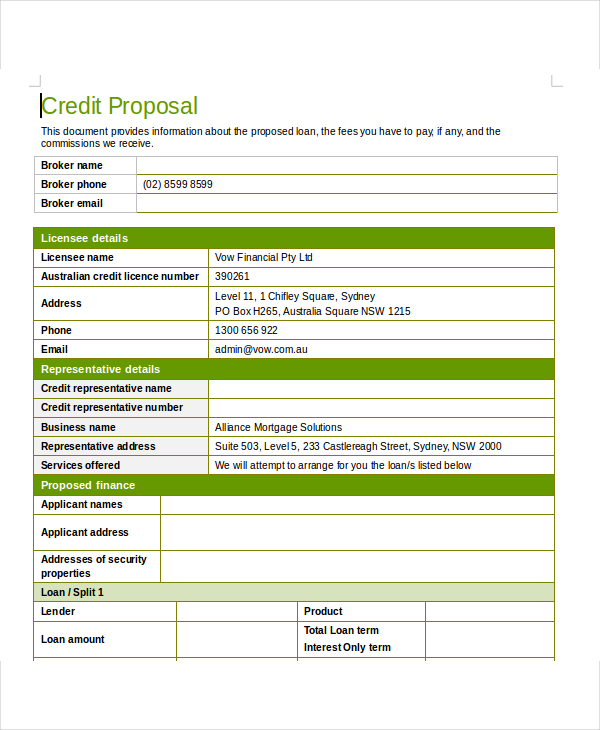

Loan Proposal 11 Examples Format Pdf Examples

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Quicken Loans Vs Amerisave In 2022 Home Refinance Quicken Loans Family Finance

What Does Your Mortgage Payment Consist Of A Mortgage Payment Is Typically Made Up Of Four Components Principal Mortgage Payment The Borrowers Loan Amount

A Little Cheat Sheet To Help You When Buying A Home Call Me When You Re Ready Or Have Any Questions Remax Home Buying Things To Sell

Personal Finance Tips How To Borrow Money Wisely The Borrowers Borrow Money Best Loans